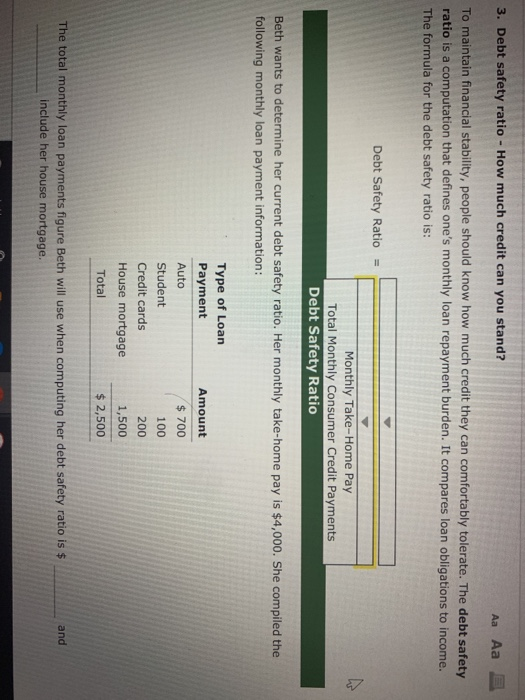

debt safety ratio

Debt safety ratio Monthly consumer credit payments Monthly take-home pay. With more than half your income before taxes going toward debt payments you may not have much money left to save spend or handle unexpected expenses.

|

| How To Calculate My Debt To Income Ratio Personal Finance Series Youtube |

Debt Safety Ratio Total Monthly Consumer Credit Paymonts -1.

. You should take action to improve your DTI ratio. Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. The proportion of total monthly consumer credit obligations to monthly take-home pay. The formula for the debt safety ratio is.

If a loan has a prepayment penalty there will be an additional cost to repay the loan early. In order to calculate the debt to assets ratio we would add all funded debt together in the numerator. A frequent flyer card can be aptly classified as an. This indicates the percentage of gross income that goes toward housing costs.

Lending institutions such as banks and credit card companies use debt safety ratio and other financial metrics to assess whether to approve a. It compares loan obligations to income The formula for the debt safety ratio is. Debt Safety Ratio Total Monthly Consumer Credit Payments Monthly Take-Home Pay Debt Safety Ratio Ana. Used when a person.

A ratio of 15 or lower is healthy and 20 or higher is considered a warning sign. It compares toan obligations to income. Form of credit extended to a. An arrangement for scheduled debt repayment over future years that is an alternative to straight bankruptcy.

Debt safety ratio Total monthly consumer. Debt to income ratio. If Lizas debt safety ratio is 15 and her monthly take-home pay is 4500 which of the following equals her total monthly payments. Debt safety ratio is the ratio of monthly consumer debt payments to the monthly take-home pay expressed as a percentage.

His latest tally shows that he still owes 4000 on a home improvement loan monthly payments of 125. The formula for debt safety ratio is as follows. Payments monthly take home pay. The debt safety ratio is a computation that defines ones monthly loan repayment burden.

We dont make judgments or prescribe specific policies. Generally speaking a debt-to-equity or debt-to-assets ratio below 10 would be seen as relatively safe whereas ratios of 20 or higher would be considered risky. In this case it yields a debt to assets ratio of 05789 or expressed as a percentage. Calculating debt safety ratio.

Free to Use for Ages 18 Only. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Nancy can take on additional consumer debt because her debt safety ratio is lower than the experts guidelines. The debt safety ratio is a computation that delines ones monthly loan repayment burden.

Debt safety ratio guidelines and how to calculate The proportion of total monthly consumer credit obligations to a monthly take-home pay. Every six months Larry Sun takes an inventory of the consumer debts that he has outstanding. Nancy cannot take on additional consumer debt because her debt safety ratio is lower than the experts guidelines. He is making 85 monthly payments.

- Debt safety ratio greater than 20 - Inaccurate credit report that reflects a poor credit history - History of personal bankruptcy - False or misleading information on your application - Large amount of available credit relative to income - Absence of checking savings or other credit. Ad Get Helpful Advice and Take Control of Your Debts. 18061 66166 27569 then divide it by the total assets of 193122. Should be less than 20.

Only installment personal loan and revolving credit payments are used in the calculation. With this DTI ratio lenders may limit your borrowing options. Using the facts from the example. Know Your Options with AARP Money Map.

See what makes us different.

|

| Solved Use Worksheet 6 1 Rebecca Collins Is Evaluating Her Debt Chegg Com |

|

| Solved 3 Debt Safety Ratio How Much Credit Can You Stand Chegg Com |

|

| Departmental Results Report 2020 21 |

|

| Financial Strength Travelers Insurance |

/liquidity-coverage-ratio_final_2-a961e22424864d36b150f62467e2c5ab.jpg) |

| Liquidity Coverage Ratio Lcr Definition |

Posting Komentar untuk "debt safety ratio"